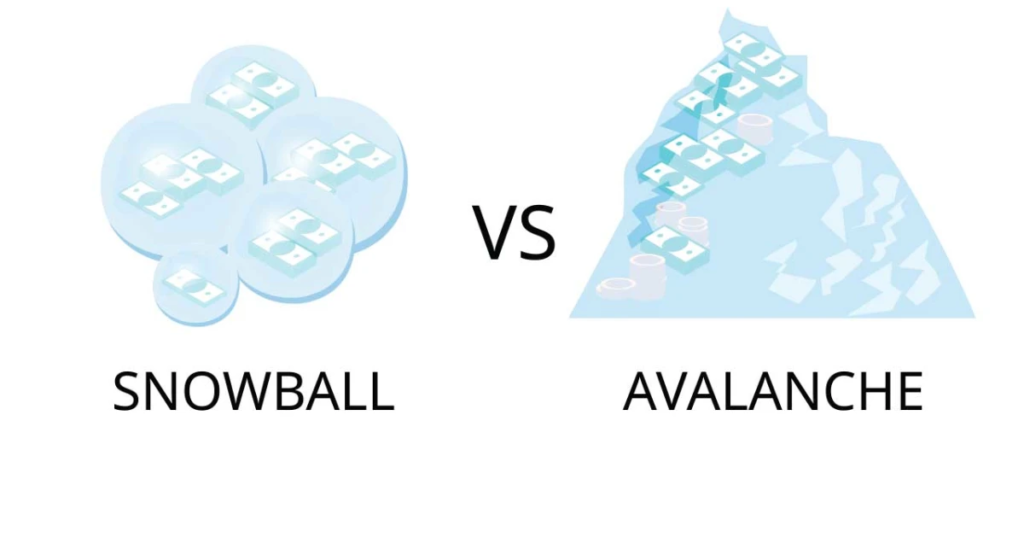

Debt can seem like an unbounded mountain always rising. Your payments seem to have hardly any effect, regardless of how hard you try. Paying off debt, though, does not have to feel unattainable. Two well-liked strategies people employ to quickly pay off debt are the Debt Snowball and the Debt Avalanche. Each has advantages; the best decision will rely on your attitude and financial situation.

Understanding the Basics of Debt Repayment

Let us discuss what paying off debt actually means before we weigh the two approaches. Making only the minimum payments on credit cards, student loans, or personal loans will trap you for years if you have several debts. Interest mounts and the balances do not shrink quickly enough.

Structured debt repayment plans therefore make sense. They present you with a scheme. They support your keeping of motivation and concentration. Two of the most often used techniques are the Debt Snowball and Debt Avalanche, although they operate in rather different ways.

The Debt Snowball Method

Under the Debt Snowball approach, you make minimum payments on everything else while first paying off the smallest debt. You go to the next smallest debt once the smallest one is gone. The concept is to create momentum—akin to a snowball gathering speed as it descends a hill.

Motivation is the reason it works. You feel successful when you eliminate a little debt. You stay going with that emotional triumph. It is like finishing chores on a to-do list. You get more driven, and the more you clear.

If you owe three debts, for instance:

- A $500 credit card bill

- A $3,000 personal loan

- A $10,000 student loan

You start with the credit card with $500 worth. Once that pays off, you address the $3,000 loan using the funds you were paying on that. Then you pursue the $10,000 loan after that is gone.

This approach keeps you motivated even though it does not concentrate on interest rates. You make rapid improvement, which keeps you dedicated to paying off debt.

The Debt Avalanche Method

The debt avalanche approach operates differently. You concentrate on the debt with the highest interest rate instead of beginning with the least amount owing. Because it lowers the interest you pay, mathematically this approach saves you the most money over time.

Returning to the same three debts:

- A $500 credit card with 20% interest

- A $3,000 personal loan with 10% interest

- A $10,000 student loan with 5% interest

Using the Avalanche approach, you pay off debt with the highest interest rate—that of the $500 credit card first. You next go to the $3,000 loan and lastly the $10,000 student loan.

Those driven by statistics will find this method most effective. Initially, it is not as emotionally fulfilling since some high-interest debt is sizable and takes more time to pay off. On the other hand, this approach will perform better over time if your main focus is money saving.

Which One Is Best in 2025?

Knowing how both strategies work, which one makes the most sense in 2025? The cost of borrowing is more than it has ever been given growing interest rates. Given this, the Debt Avalanche approach appeals more since it saves the most money. But financial success is about behavior not only about numbers.

Should you find it difficult to keep motivated, the Debt Snowball could be a better option. Although you pay a little more in interest, seeing little debts vanish can help you stay on target.

The Debt Avalanche is your best choice if you want to save every dollar available and are quite disciplined. The secret is knowing yourself and selecting the approach to keep you moving until all of your debt is paid off.

Combining Both Methods for Maximum Success

Who claims you have to choose only one? Once they feel more confident, some people begin with the Snowball approach to get quick wins and then move to the Avalanche approach. This hybrid approach offers the best of both worlds—cost savings and momentum.

To feel successful, for instance, you might pay off one or two little debts first. Then turn around and target the debt with the most interest. The secret is to remain adaptable depending on your improvement.

Common Mistakes to Avoid

Whichever approach you decide on, there are some typical errors to be alert for:

- Not sticking to the plan: Payback on debt takes time. You can slow down by jumping between several techniques or by losing focus.

- Taking on more debt: Steer clear of the trap of paying off one loan only to then grab another. You want debt gone, not to juggle it.

- Ignoring emergency savings: Should an unanticipated cost arise and you lack savings, you may have to turn back to credit. Even a tiny emergency fund can help to avoid this.

- Paying only the minimums: Paying extra is what gets you out of debt fastest regardless of your approach. Stuck with minimum payments, progress will be slow.

Final Thoughts

While the Debt Avalanche approach saves most money, the Debt Snowball approach keeps people motivated. Both work to pay off debt; what counts is selecting the one you will be able to follow.

If you want to make managing your finances easier, check out the digital budget trackers and planners at CrystalHanes. Staying organized is the first step to financial freedom!

Frequently Asked Questions (FAQs)

Which saving technique works better?

Because the Debt Avalanche approach concentrates on first paying off high-interest debt, it saves the most money over time. This is the best option if you want to pay as little interest as you could possibly allow.

Which approach speeds things up more?

Though both approaches take time, the Debt Snowball approach can feel faster since you quickly pay off little debt. This momentum keeps you driven and facilitates your ability to follow your debt payback schedule.

What would happen if the Debt Avalanche saps my drive?

Try a hybrid strategy if you find it difficult to remain motivated with the Avalanche approach. It pays off one or two small debts first (Snowball) then goes on to target high-interest debt (Avalanche). You thus obtain financial savings as well as psychological gains.